Certain provisions of the Code on Wages, 2019 have been notified to have come into force on 21st November, 2025.

Key effects in force with implementation of the Code on Wages, 2019 are –

• Uniform definition of wages with Allowances exceeding 50% made part of Wage

• Statutory National Floor Wage introduced

• HRA cannot be part of the minimum wages.

• The Code applies uniformly to all employees, regardless of their salary level. Consequently, all statutory registers—both under the Code and under existing labour laws—must capture details of every employee, and cannot be limited only to those earning up to ₹24,000 gross per month.

• Statutory right for minimum wage extended to all employees

• On the timelines for disbursing wages during the full-and-final settlement process, arising from the extension of the payment-of-wages provisions to all employees, regardless of their designation or salary level.

• The bonus eligibility ceiling has not yet been notified by the Appropriate Government. Until such notification is issued, employers must continue to apply the existing wage threshold of ₹21,000 per month.

• Procedural compliances under the Code will become operative only upon the notification of the corresponding Rules.

Provisions of Code on Wages, 2019 implemented from 21st November, 2025

| Sr. No. | Sections | Chapter / Title (from Code) |

|---|---|---|

| 1 | Sections 1 to 41 | Preliminary, Minimum Wages, Payment of Wages, Bonus, Advisory Board — includes definition of “wages”, universal minimum wage for all workers, National Floor Wage, timely payment of wages for all employees (irrespective of wage ceiling), and principles of equal remuneration/gender equality. |

| 2 | Sub-sections (4) to (9) of Section 42 | Advisory Board — relates to constitution and functioning of the Central Advisory Board for matters of minimum wages, gender equality, and welfare. |

| 3 | Sections 43 to 66 | Payment of Dues, Audit, Inspector/Facilitator, Offences & Penalties, Miscellaneous — covers framework for claims, offences, penalties, compounding of offences, and the role of the Inspector-cum-Facilitator. |

| 4 | Sub-section (1), clauses (a) to (r) and (u) to (zc) of sub-section (2), and sub-sections (3) to (5) of Section 67 | Power of Appropriate Government to Make Rules — gives the Central Government authority to frame rules on wage calculations, records, and procedural guidelines. |

| 5 | Section 68 | Power to remove difficulties — empowers the Central Government to resolve issues arising during implementation. |

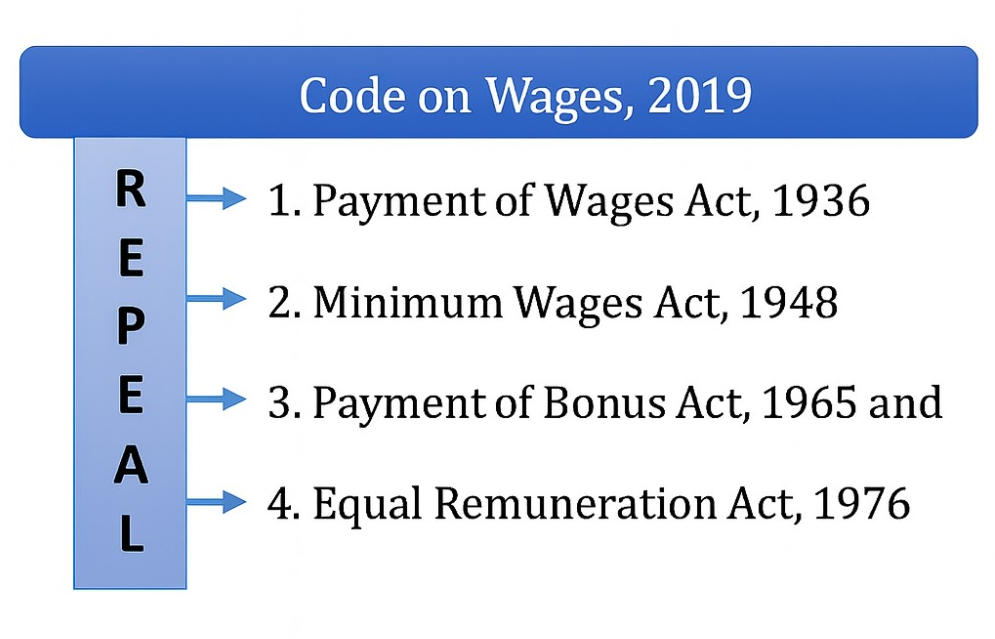

| 6 | Section 69, except provisions mentioned at Serial No. 3 of S.O. 4604(E), dated 18 Dec 2020 | Repeal & Savings |

Earlier in 2020, the Government of India vide Notification No. S.O. 4604(E) dated December 18, 2020, brought into force the following provisions of the Code on Wages, 2019 with effect from the date of publication of this notification in the Official Gazette i.e. from 18th December, 2020.

Provisions of Code on Wages, 2019 implemented from 18th December, 2020

| Sr. No. | Sections | Chapter (Title from Code) |

|---|---|---|

| 1 | Sub-sections (1), (2), (3), (10) and (11) of Section 42 (to the extent they relate to the Central Advisory Board) | Central Advisory Board and State Advisory Boards |

| 2 | Clauses (s) and (t) of sub-section (2) of Section 67 (s) Procedure for Central & State Advisory Boards and their committees under Section 42(10). (t) Terms of office of members of Boards and committees under Section 42(11). | Power of appropriate Government to make rules |

| 3 | Section 69 (to the extent it relates to Sections 7 & 9 (Central Government) and Section 8 of the Minimum Wages Act, 1948) | Repeal and Savings |