Certain provisions of the Code on Social Security, 2020 have been notified to have come into force on 21st November, 2025.

Key effects in force with implementation of the Code on Social Security, 2020 are –

- Universalization of Social Security by including Gig and Platform Workers in its ambit

- Limitation period of 5 years for inquiry in past cases

- Provision to promote woman workers by introducing Work-from-home option after maternity leave and mandatory crèche facility for establishments with 50 or more employees

- EPF Appeal deposit amount reduced from 75% to 25% of assessed liability.

- ESIC coverage and benefits are extended Pan-India — voluntary for establishments with less than 10 employees, and mandatory for establishments with even one employee engaged in hazardous processes.

- Current ESI Schemes shall be followed for one year till 20-11-2026.

- Establishment having branches in more than one state – Central government shall be the appropriate government – Maternity benefit Act

- Consequences of bringing contract labour within the scope of ‘employee’, particularly with respect to gratuity payments, an area where the principal employer has not previously borne direct statutory responsibility.

- Effects of the revised ‘wages’ definition on the calculation of statutory contributions, including employees’ provident fund, employees’ state insurance, and gratuity, given that these computations may undergo significant recalibration under the new framework.

- Provision allowing voluntary inclusion or exclusion from the requirements relating to Employees’ Provident Fund contributions and Employees’ State Insurance contributions.

- Fixed-term employees will be entitled to gratuity upon completion of a contract period exceeding one year, payable at the end of the contract.

- As the Rules have not yet been notified, procedural requirements under the Code will apply only once issued; until then, employers should continue to follow the existing procedures.

Provisions of Code on Social Security, 2020 implemented from 21st November, 2025

| Sl. No. | Sections / Provisions | Chapter Title(s) |

|---|---|---|

| 1 | Sections 1 to 14 | Preliminary, Social Security Organisations, Appointment of officers of Central Board. [Definitions, applicability & social security framework] |

| 2 | Sub-sections (1) & (2) of Section 15 | Power of Govt. to make Schemes under EPF [EPF Scheme, Pension Scheme, EDLI Scheme, PF Scheme provisions] |

| 3 | Clause (c) of sub-section (1) of Section 16 | Establish a Deposit-Linked Insurance Fund for the Insurance Scheme |

| 4 | Sections 17 to 141 | EPF, ESIC, Gratuity, Maternity, Employees’ Compensation, BOCW Social Security, Gig & Platform Workers, Finance & Accounts, Compliance, Offences & Penalties, Employment Info, Social Security Fund |

| 5 | Section 143 (except provisions under S.O. 2060(E) dated 3 May 2023) | Power to exempt establishments [Repeal of earlier laws & transitional arrangements] |

| 6 | Sections 144 to 163 | Miscellaneous [Penalties, compounding, rule-making, enforcement procedures] |

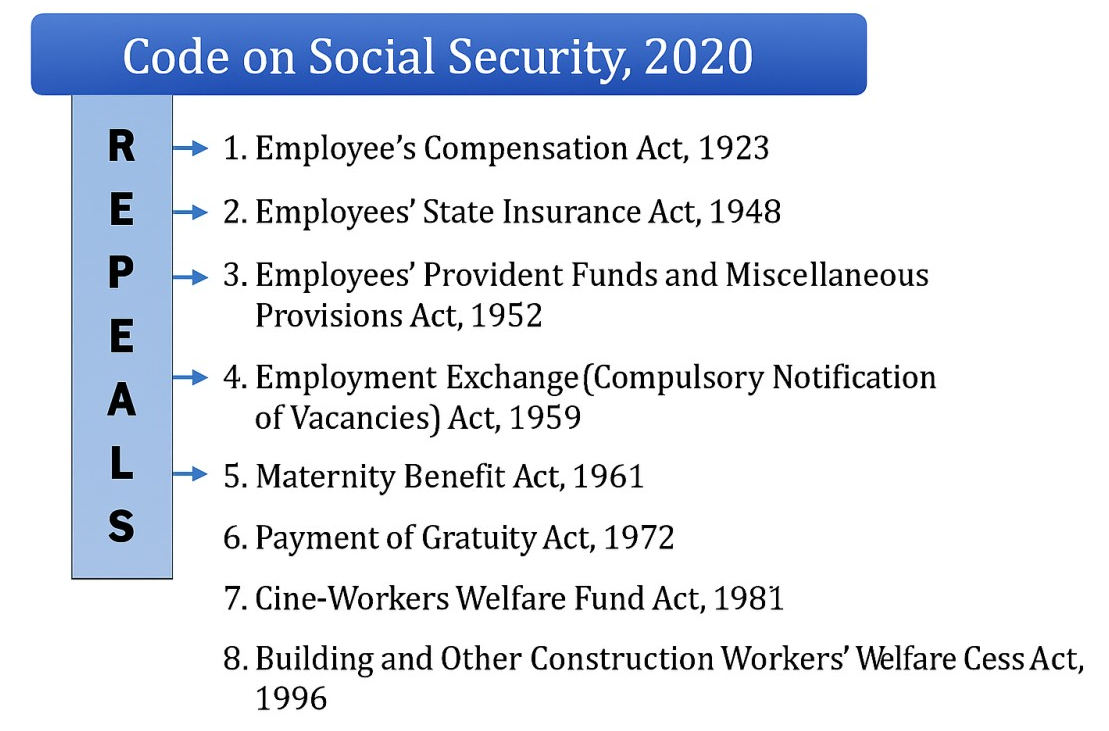

| 7 | Items 1 & 2 and Items 4 to 9 of sub-section (1) of Section 164 (1) Employee Compensation Act 1923 (2) ESI Act 1948 (4) Employment Exchange Act 1959 (5) Maternity Benefit Act 1961 (6) Payment of Gratuity Act 1972 (7) Cine Workers Welfare Fund Act 1981 (8) BOCW Cess Act 1996 (9) Unorganised Workers Social Security Act 2008 | Repealed Enactments & Savings |

| 8 | Clause (a), clause (c) of sub-section (2), and sub-sections (3) of Section 164 | Repeal & Savings [Exemptions under repealed Acts continue until expiry] |

Earlier in 2023, the Government of India vide Notification No. S.O. 2060(E) dated May 3, 2023 brought into force the following provisions of the Code on Social Security, 2020 with effect from 3rd day of May, 2023.

Provisions of Code on Social Security, 2020 implemented from 3rd day of May, 2023

| Sl. No. | Sections / Provisions | Detailed Provision |

|---|---|---|

| 1 | Section 15(3) (related to EPS 1995) | Scheme provisions may take effect prospectively or retrospectively from date specified in the scheme. |

| 2 | Section 16(1)(a) (related to EPS 1995) | Central Government may establish a Provident Fund for PF Scheme. |

| 3 | Section 16(1)(b) | Central Government may establish a Pension Fund for Pension Scheme. |

| 4 | Section 16(2) (related to EPS 1995) | PF, Pension & Insurance Funds vest in and administered by Central Board as per respective schemes. |

| 5 | Section 143 (related to Section 16(1)(b)(ii) for EPS 1995) | Payment of contribution by employers of exempted establishments to which the pension scheme applies. |

| 6 | Section 164(1) — repeal of provisions of EPF Act, 1952 (Item 3) | Repeal of Employees’ Provident Funds & Miscellaneous Provisions Act, 1952. |

| 7 | Section 164(2)(b) (related to EPS 1995) | PF Scheme 1952, EDLI 1976, EPS 1995, Tribunal Rules 1997, etc. remain in force (not inconsistent) for 1 year from commencement. |